CPHI Milan Disruptors 2024

Potentially disruptive, independent exhibitors at CPHI Milan 2024.

Welcome to our Watchlist,

in partnership with CPHI Milan

We are delighted to present our bespoke Watchlist created in conjunction with CPHI Milan 2024. This Watchlist aims to highlight and raise the profile of the CPHI Milan Disruptors, i.e. the lower-midsized and independent players.

We filtered, analysed, and categorised all of the exhibitors to identify the CPHI Milan Disruptors. Typically, these companies are agile with interesting technologies and are the driving force of innovation in the sector.

"In this Watchlist, we explore the CPHI Milan Disruptors, i.e. the privately owned, lower-midsized players exhibiting at CPHI Milan.

They are agile, innovative, and have a relentless drive to push forward the pharmaceutical industry."

Matthew Wise

Head of Data

Watchlist Snapshot:

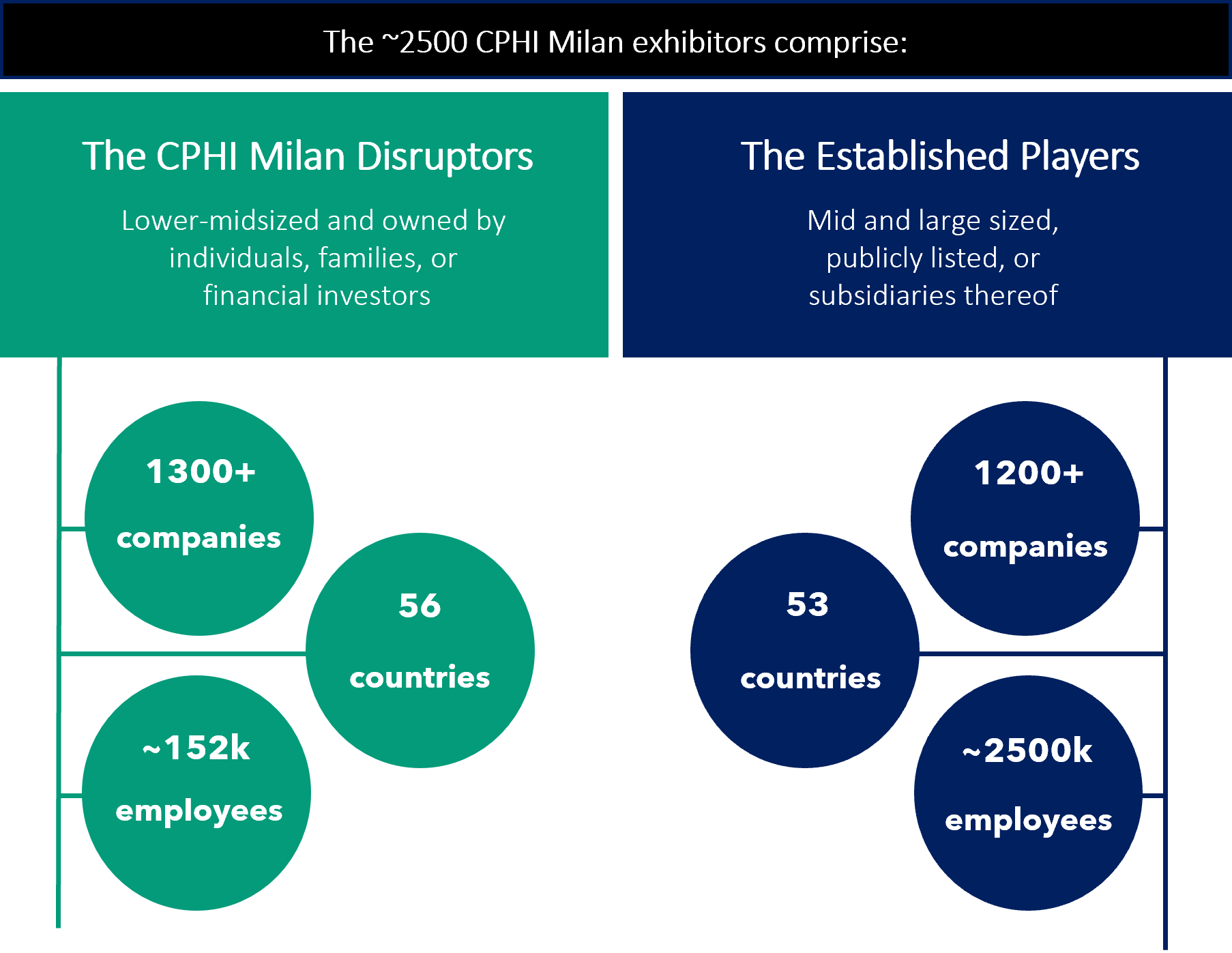

Our Watchlist features analysis on the lower-mid sized and privately owned businesses exhibiting at CPHI Milan. A snapshot below

Exhibitor Breakdown

CCD Partners Insight:

Key findings on the trends and challenges faced by pharma businesses, based on 100+ conversations with industry leaders

Commentary by Matthew Wise, Head of Data, CCD Partners

Pharma’s struggle for growth: balancing innovation, instability, and inflation

The past year has been a testing one for the pharmaceutical industry. On one side, there has been much to celebrate, including breakthroughs in cancer treatment, new classes of drugs targeting obesity, and advancements in modern therapeutic techniques such as cell therapy, gene therapy, and mRNA vaccine development. However, despite these global successes, the industry is facing significant challenges stemming from macroeconomic factors, regulatory pressures, and rising environmental standards, which are creating increasingly strong headwinds across the entire value chain.

Macroeconomic and geopolitical factors are exerting cost pressures across the P&L, with rising raw material prices, supply chain instability, labour shortages, and wage inflation collectively suppressing earnings. Additionally, the Inflation Reduction Act, which allows Medicare to negotiate drug prices, is expected to disrupt traditional pricing models and potentially reshape the U.S. market. These conditions have reduced profitability and put a strain on R&D spending, particularly upstream in the pre-clinical discovery space, where many businesses are struggling and some are becoming insolvent.

Not only has overall R&D spending weakened compared to previous years, but the focus of these investments is also beginning to shift. Over the past decade, many firms have prioritized investment in well-documented biological pathways rather than exploring newer, less understood alternatives, which inherently carried higher risks.

Matthew Wise

Head of Data, CCD Partners

This risk-averse strategy was adopted by many businesses, leading to intense competition and driving down profitability across the board. “Specialty” drugs offer an entry into high-margin market segments, but as competition increases in these areas too, margins are being eroded, and their inherently small patient populations offer limited scalability

Amid these challenges, digital transformation adds another layer of complexity. The effective integration of AI is becoming increasingly important to the industry's evolution and companies are adopting tools to enhance operations across the value chain, from R&D to patient engagement. As AI continues to evolve, pharmaceutical companies will need to carefully select tools that complement their existing processes to achieve meaningful benefits.

Where will pharmaceutical companies look for innovation going forward? Firms are increasingly focusing on large and untapped markets, including obesity and Alzheimer’s disease. While these markets present clear opportunities for innovation and growth, they also come with higher risks related to development, lack of scientific knowledge, regulatory approval, and market acceptance. This shift in strategy reflects the industry's need to search for new growth avenues, and time will tell which companies are willing to take the greatest risks to gain market share in these “blue ocean” therapeutic areas.