Turbulent markets and riding post-pandemic momentum are not enough to ensure success!

Steve Holland • July 1, 2021

Logistics and raw material shortages are challenging producers and distributors alike to meet the needs of customers as the worldwide effect of the pandemic continues to create unprecedented and volatile supply chain performance.

Indeed, it will be months - and in some cases years - before we get back to pre-pandemic conditions.

However, a competitive advantage can be achieved for those prepared to look beyond today’s horizon and position themselves accordingly.

Post-pandemic performance projections

It is common for both strategy and execution to be based on what we might call ‘cherished' assumptions about addressable market size, opportunity, and conversion rates.

All growth is measured and judged by comparing a prior year’s performance vs perceived opportunity and by how successful the execution of sales or product strategy was during the period.

With that said, the current volatility in the world economy, and the significant impact this has had on normal market dynamics, offers a unique opportunity to challenge those assumptions:

How will your future performance be measured, and do you need to re-establish, adjust, or correct your understanding of the market in a pandemic and post pandemic world?

For example, most distributors and producers operate within defined geographical boundaries, and, in some cases, specific industry verticals to determine a baseline assumed market size and benchmark to determine growth.

The inconvenient truth is that the market size and growth potential is subject to data inaccuracy or misinterpretation, with under or over-reported potential creating a false baseline against which to assess success.

This is not a new risk for industry to factor in, but what is new is the size of that risk - and the scale of impact.

A rapidly changing landscape

Unpredictability is high off the back of a global event, and businesses small and large will be paying the price of inaccurate market forecasting in the near years to come.

Industry players are still scrabbling to react to the tumultuous period of the last 12 months, with an understandablefocus on competitors, customer churn and sales management. There should however be a call to action to ensure that each business looks beyond today's crisis and positions itself for future growth.

Bearing this in mind, and looking at the chemical industry specifically, from a producer perspective the distributor sector remains incredibly fragmented, adding further uncertainty to future planning.

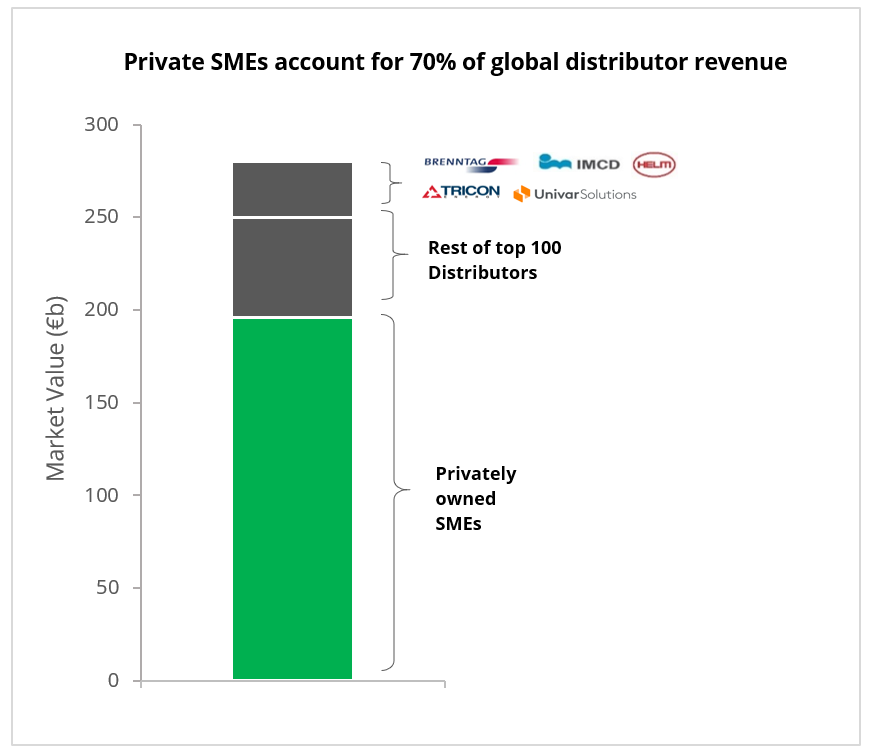

For example, if we look at published numbers from reputable consultant groups, industry publications and indeed information found within the publicly quoted companies, we can identify that the top 100 distributors worldwide only account for 30% of the estimated 280 billion Euro market.

There is also without question an opaque view on both size and composition of the sector in large regions of China, southeast Asia, and India which also account for a significant share of the global production capacity for chemicals. We often hear of consolidation of the sector by the larger distributors, but the reality is despite their capacity to acquire, it will be many years before we see the type of consolidation seen in other distributor markets.

Additionally, when planning it is important to remember that working with the best is not an exclusive characteristic of the largest.

Regional companies retain local market leadership and share through high service content and agility. Following the logic through suggests that they account for 70% of the overall market and should therefore be a thoughtful consideration when plotting out the future.

All stakeholders in the supply chain are equally tasked with addressing the ongoing development of environmental and sustainability actions and alignment of such values are essential to any long-term success.

Add to this an expansion of digital services and platforms, increased technical expertise within industry verticals and more value-added services, the time is now to reassess the ‘cherished' assumptions about each market.

Planning for long-term success

The effectiveness of any article which challenges the status quo can be measured by the critical questions it prompts.

In the case of producers:

Are we using the most effective channel to market, and do we achieve our true potential on market share for our products and services?

This can equally apply to distributors in challenging their own effectiveness in delivering value-added and unrivalled service to re-ignite growth and gain market share.

Companies who do this systematically and take the time to look beyond the horizon - despite the turbulent times we are in - will be the winners of the future, with improved market share and penetration.

Just as the competition were looking the other way!

CCD Partners is a consultancy specialised in corporate transformations in small and mid-market chemicals and life sciences businesses.

To organise a call with one of our partners please email contact@ccdpartners.com

Receive M&A news relevant to your business

At critical moments our clients engage us to provide pre-publicity "off-market" intelligence to give them the edge over the competition - we also provide up-to-the-minute public or "on-market" intelligence for free

Contact Us

RECENT POSTS

In the latest episode of the Chemical Transformations podcast , CCD Partners' Managing Partner Matt Dixon speaks with Ted Clark, former President and CEO of Royal Adhesives & Sealants, discussing his new book "Shipping Clerk to CEO: The Power of Curiosity, Will, and Self Directed Learning”. The book tells the story of Clark’s remarkable career journey from entry-level worker to CEO of a $240m chemical company by the age of 42.

Biosynth Carbosynth is a fully hybrid Research Products, Life Sciences Reagents and Custom Synthesis and Manufacturing Services Company with global research, manufacturing and distribution facilities. They are the supplier of choice for many in the pharmaceutical, life science, food, agrochemical, cosmetic and diagnostic sectors and manufacture and source a vast range of chemical and biochemical products.

Steve Allin co-founded Charnwood Molecular with Phil Page in 1998. 22 years later, the business has evolved dramatically from its origins as a spinout of Loughborough University. Backed by a partnership with Synova Capital, the company is now preparing to move into a former AstraZeneca research facility and has already completed its first M&A deal, acquiring Aurelia Bioscience in summer 2021. CCD Partners’ Matt Dixon spoke with Steve about the journey from full-time academia to running a high-growth market leader.